Welcome to the world of property investment! If you’re new here, you might be looking for a strategy to kickstart or grow your property portfolio without needing a huge pile of cash up front. That’s where the BRRR strategy comes into play. Property Filter breaks it down into simple steps for you to understand how it can work for you.

Step-by-Step Breakdown of BRRR

1. Buy

The journey starts with buying an investment property. You’re looking for a diamond in the rough – something priced lower than what it could be worth, after some property refurbishment. The goal here is to find properties that need work; this could be anything from a new kitchen to a full-scale renovation. Often, these properties are bought with a bridging loan – a short-term loan that helps you snap up properties quickly.

Key Point: The price you pay now affects everything that comes next, so getting a good deal is crucial. A smart purchase increases the potential Return on Investment (ROI), setting a strong foundation for the steps that follow.

2. Refurbish

Now it’s time to roll up your sleeves. Adding value through refurbishment could mean fixing structural issues, painting and decorating, or updating the plumbing. The aim is to do just enough to significantly increase the property’s value without overspending. This is where your ability to budget and plan efficiently is tested.

Key Point: Spend wisely. Luxurious finishes might look nice but think about what is essential to increase the property’s value and appeal to future tenants. Effective refurbishment is key to maximising the ROI by enhancing the property’s capital appreciation.

3. Refinance

After the refurbishment, your property should have increased in value. This is when you refinance, switching from your bridging loan to a long-term mortgage based on the property’s new value. If done right, this step allows you to pay off the bridging loan and potentially pull out some, or all, of the money you initially invested.

Key Point: You’re essentially unlocking the value you’ve added to the investment property, making your money work smarter, not harder. This crucial step significantly impacts your ROI by enabling you to recover your initial investment and reinvest in new opportunities.

4. Rent

The final step is renting out your newly refurbished property. The rent should cover your mortgage payments and expenses, with some left over as profit. Plus, if you’ve chosen well and managed your refurbishment budget smartly, your property should also attract good tenants quickly.

Key Point: Quick tenant placement is essential. Empty properties don’t just miss out on income; they also cost money in ongoing expenses such as energy and council tax. Successfully renting out your property solidifies your ROI (Return on Investment), turning it into a steady stream of income.

What is a Bridging Loan?

A bridging loan is a short-term financing option used primarily in property transactions to ‘bridge’ the gap between the purchase of a new property and the sale of an existing one or the arrangement of longer-term financing. It’s known for its speed and flexibility, making it a popular choice for property investors looking to quickly secure properties that may not qualify for traditional mortgages due to the property’s condition.

What is ROI (Return on Investment)?

ROI, or Return on Investment, is an equation that calculates the profit you’ve made from your investment in relation to its original cost.

For example: You purchase a property for £100,000 and spend an additional £10,000 on renovations. If you then sell the property for £150,000, your profit will be the difference between the selling price and your total investment.

The equation for ROI is:

For example: Cost of the Investment: £110,000 (£100,000 for the purchase + £10,000 for renovations) Profit from the Investment: £150,000 (sale price)

This calculation indicates a 36.36% profit on your initial investment.

The ROI equation is crucial for comparing the profitability of various investments, guiding you toward informed decisions on where to invest your funds for the best returns in your property investments.

What is a Long-Term Mortgage?

A long-term mortgage is a more permanent financial solution that replaces the bridging loan once a property has been refurbished and increased in value. Typically taking the form of a buy-to-let mortgage for investors, it’s based on the property’s new, higher value, allowing property investors to potentially draw out their initial investment and use it for future projects.

Advantages of the BRRR Property Investment Strategy

- Low Starting Capital: Get into property investment without needing a large initial sum.

- High ROI (Return on Investment): Small upfront investment can lead to significant returns, especially if you can recycle your initial investment through refinancing.

- Lower Maintenance Costs: A freshly refurbished property often means fewer repair headaches down the line.

- Growth Opportunity: Successfully recycling your investment allows you to repeat the process, growing your property portfolio.

Challenges to Consider

- Renovation Risks: Overrunning costs and time can eat into profits. Having a buffer budget for unexpected costs is wise.

- Down Valuation: There’s a risk the post-refurbishment valuation won’t meet your expectations, impacting your ability to recycle your initial investment.

- Void Periods: Time without tenants means covering costs yourself. Efficiently finding tenants is key.

Making It Work

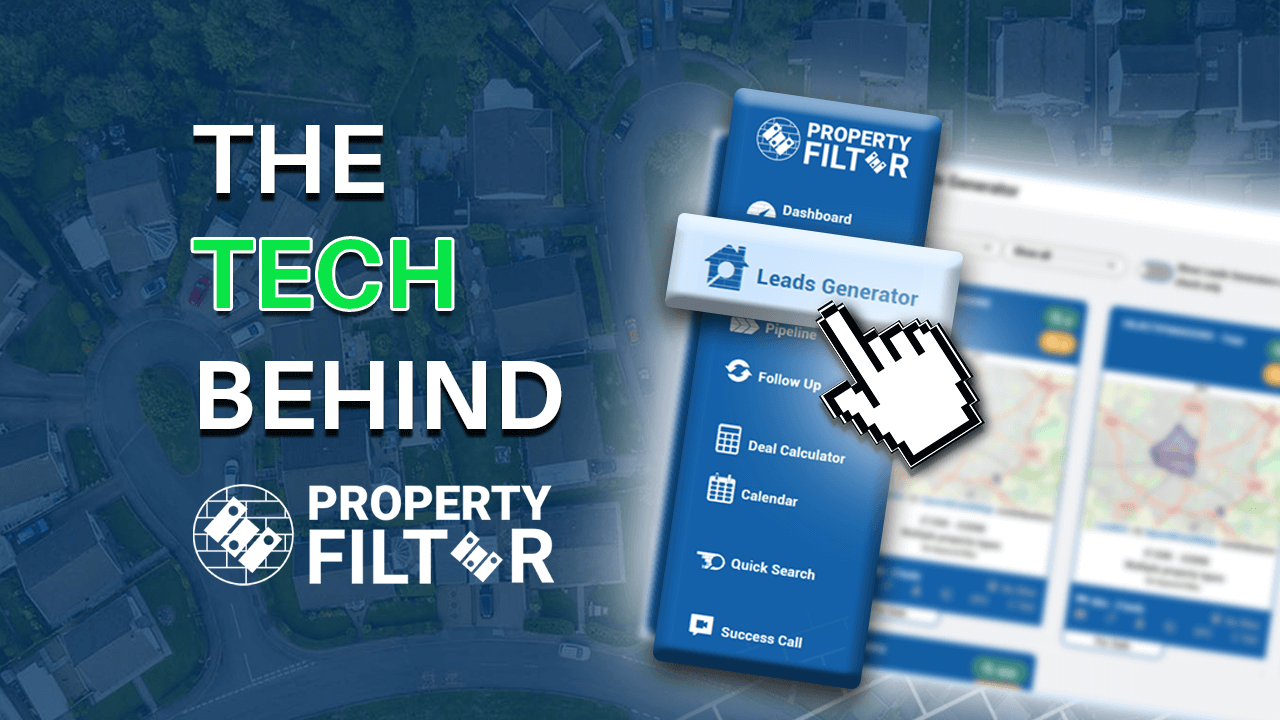

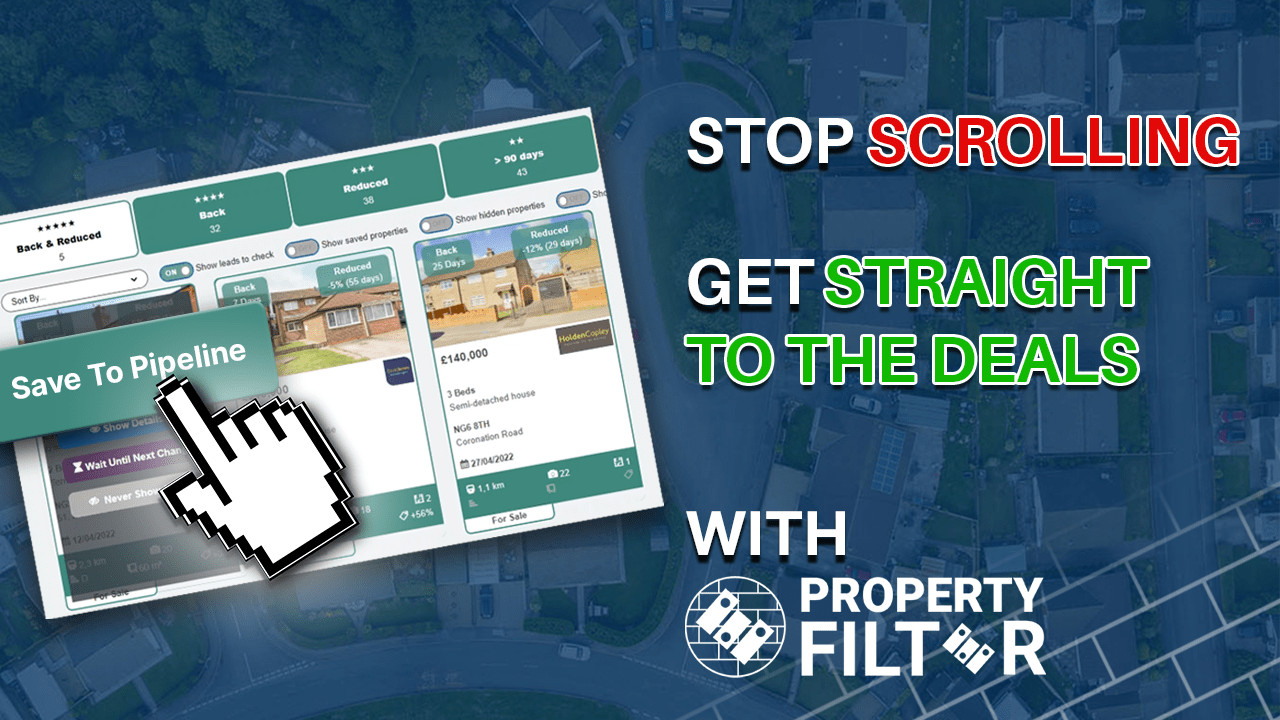

Succeeding with BRRR in the UK’s property market requires doing your homework, understanding local property values, and having a clear plan for each step of the process. This is where Property Filter is incredibly effective and efficient with it’s blueprint. Start with properties that need work but are in good locations, manage your refurbishment budget carefully, and ensure your refinanced mortgage allows for a profitable rental income.

Remember, the BRRR strategy is about making informed decisions, smart investments, and efficient use of funds. With the right approach, which includes smart deal finding with Property Filter, it can be a powerful way to build and grow your property portfolio.